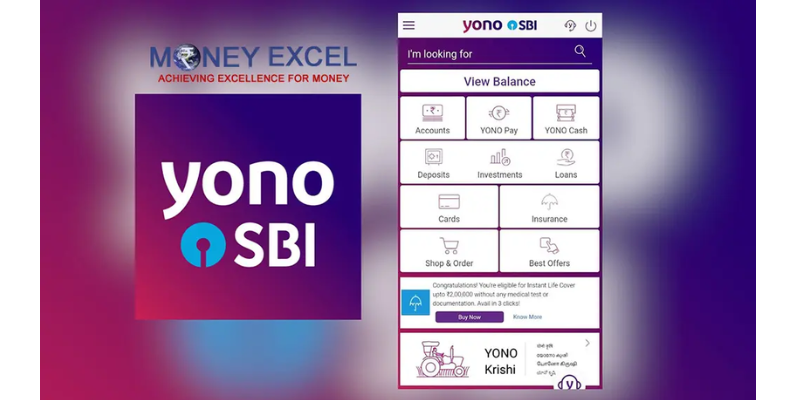

State Bank of India (SBI) recently announced a series of new features for its popular YONO (You Only Need One) mobile banking app. These updates are aimed at enhancing the overall user experience and making banking easier and more convenient for its customers. In this article, we will discuss some of the key new features that have been introduced in the SBI YONO app and how they can benefit users.

One of the major new features added to the YONO app is the ability to open a fixed deposit (FD) account online. This feature allows users to create an FD account without visiting a bank branch, making the process quicker and more convenient. With just a few taps on the app, customers can choose the amount to deposit, the term of the FD, and other relevant details to set up their fixed deposit account instantly.

Another notable addition to the YONO app is the introduction of the ‘Invest’ section, which allows users to explore various investment options and make informed decisions about their financial future. The app provides users with access to a wide range of investment products such as mutual funds, insurance, and SIPs (Systematic Investment Plans), making it easier for customers to manage their investments from the comfort of their home.

SBI has also introduced a new feature called ‘Quick Pay’ in the YONO app, which enables users to make payments quickly and securely using UPI (Unified Payments Interface). This feature allows users to pay bills, transfer money, and make online purchases with just a few taps on their mobile device. With Quick Pay, users can set up recurring payments for their utility bills, saving them time and effort each month.

In addition to these features, the YONO app now offers a personalized dashboard that provides users with a comprehensive view of their finances in one place. The dashboard displays information such as account balances, recent transactions, upcoming payments, and personalized recommendations based on the user’s spending patterns. This feature helps users stay on top of their finances and make more informed decisions about their money management.

SBI has also enhanced the security features of the YONO app to provide users with a more secure banking experience. The app now includes biometric authentication options such as fingerprint and facial recognition, adding an extra layer of security to protect users’ sensitive information and transactions. Additionally, users can set up transaction limits and receive instant alerts for any suspicious activities on their accounts, ensuring the safety of their funds.

Furthermore, SBI has integrated AI (Artificial Intelligence) technology into the YONO app to provide users with personalized insights and recommendations based on their individual financial goals and preferences. The app analyzes user behavior and spending patterns to offer customized suggestions for saving money, reducing expenses, and optimizing investments. This feature helps users make smarter financial decisions and achieve their long-term financial objectives.

Overall, the new features introduced in the SBI YONO app are designed to make banking easier, more convenient, and more secure for users. With the ability to open fixed deposits online, explore investment options, make quick payments, access a personalized dashboard, and benefit from enhanced security features and AI-driven insights, customers can now manage their finances more effectively from the palm of their hand.

As the banking industry continues to evolve, digital transformation plays a crucial role in providing customers with innovative solutions that meet their changing needs and preferences. By leveraging technology and introducing new features like those in the SBI YONO app, banks can enhance the overall customer experience and stay ahead in an increasingly competitive market.

In conclusion, the new features in the SBI YONO app represent a significant step towards modernizing banking services and empowering customers to take control of their finances in a digital world. With these updates, SBI reaffirms its commitment to providing cutting-edge solutions that meet the evolving needs of its customers and deliver a seamless banking experience for all.